About the Speakers

Seanita Armstrong

COO of Eco Tax Solutions

She is a visionary tax strategist, entrepreneur, and advocate for financial empowerment. As founder of Eco Tax Group, Community Choice Tax, and Community First Tax, she leads a growing network focused on tax preparation, financial education, and business ownership—especially in underserved communities.

With over a decade of industry experience and a graduate of the Goldman Sachs 10,000 Small Businesses Program, Seanita offers more than seasonal support—she delivers year-round mentorship, franchise opportunities, and training that uplift spiritually and economically. Her mission: empower everyday people to become confident, purpose-driven entrepreneurs.

Don Armstrong

CEO of Eco Tax Solutions

He combines expertise in business development and technology to deliver innovative, scalable tax software. His leadership is focused on simplifying tax preparation and empowering individuals and businesses to achieve greater financial success.

Ralph Thompson-Senior Client

Relationship Manager – Santa Barbara Tax Products Group

With over 25 years in the tax industry, Ralph Thompson has been a driving force behind client success at Santa Barbara Tax Products Group since 2009. A strategic advisor and business development expert, he partners with tax professionals and financial institutions nationwide to deliver tailored, results-driven solutions that elevate the client experience.

Candace Smith

Candace Smith- Small Business Expert

Candace Smith is a leading Small Business Tax Expert with over 10 years of experience helping entrepreneurs master tax compliance and strategy. Known for her clear, practical approach, she empowers business owners to grow confidently while staying financially sound. Candace is a sought-after speaker who makes complex tax topics simple, actionable, and engaging.

Markwei Boye-Owner

CEO at Smart Business Tax Solutions, PLLC

Markwei has brought relief to thousands across the nation—resolving over $5 million in back taxes, penalties, and interest. Led by experienced Tax Accountants and Attorneys, his firm is known for its integrity, deep client commitment, and unmatched focus on solving complex IRS problems with care and precision.

Mashi Epting

CEO- Complete Tax Training Software CTRS, MHA, CCMA

A visionary entrepreneur, mentor, and Doctor of Business Administration candidate who empowers tax professionals through education, software, and strategic business tools. As CEO of Complete Tax and Training Software and author of Turn Your Million Dollar Idea Into a Million Dollar Business, she transforms personal resilience into a mission to help others succeed with purpose and integrity.

Leri N. Lewis, EA, CTRS, NTPI Fellow

Leri N. Lewis, EA, CTRS, NTPI Fellow

As Owner of Infinity Tax Solutions and Co-Founder of the EA Leadership Academy, I specialize in tax resolution strategies—from lien and levy releases to audits and OICs—always grounded in client advocacy and integrity. A proud Board Member of the Michigan Society of Enrolled Agents, I’m committed to elevating the tax profession through mentorship, ethical leadership, and community-building.

Bryan Davis

D1 Business Liaison, from the DEGC-Detroit Economic Growth Corporation

He combines expertise in business development and technology to deliver innovative, scalable tax software. His leadership is focused on simplifying tax preparation and empowering individuals and businesses to achieve greater financial success.

Shaniece Bennett, CPA founder of Accutrak Consulting and Accounting Services PLLC

Shaniece Bennett is a CPA, business advisor, and founder of Accutrak Consulting and Accounting Services PLLC, a nationally trusted firm serving nonprofits, government contractors, and small businesses since 2009. With over 20 years of experience, she’s helped clients save millions in taxes, secure grants, and win contracts—delivering personalized financial strategy with proven results.

David M. Walker, Esq.

A seasoned business attorney with deep expertise in corporate and securities law, M&A, venture capital, and private placements. As both a legal strategist and entrepreneur—founder of his own firm and president of Starwalker Industries—he’s guided startups, investors, and professional athletes through complex deals and innovative ventures, all while serving as a respected advisor, speaker, and community leader in both Michigan and Georgia.

Emilio Jimenez, Vice President and Chief Operations Officer of Refundo

For nearly three decades, I’ve been a driving force in the professional tax preparation industry — not just adapting to change, but leading it. I started by preparing returns, then quickly rose to become one of the country's top-performing professional tax software resellers. But I didn’t stop there. I was instrumental in building a groundbreaking financial refund transfer company with a powerhouse team that disrupted a stagnant industry and redefined what’s possible. I don’t just follow trends — I build what’s next.

Mandie Schray, Business Development Representative at Refund Advantage

A seasoned Business Development Representative at Refund Advantage, where she has been helping tax professionals find the right financial products for their businesses since 2019. With over 18 years of experience in the tax industry, Mandie brings a unique combination of technical expertise and practical leadership to her role. She holds a background in Accounting and is a licensed Enrolled Agent. Prior to joining Refund Advantage, Mandie managed a high-volume retail tax office in Lansing, where she led and mentored a diverse team of tax preparers. During this time, she also played a key role in the sales, management, and integration of a client management tool designed to help tax offices of all sizes operate more efficiently. In addition to her role at Refund Advantage, Mandie runs her own successful tax practice, further grounding her in the day-to-day needs of tax professionals and business owners.

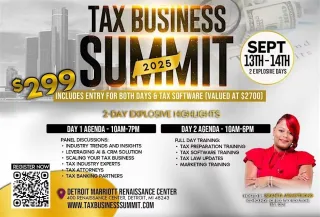

Your Questions Answered: Navigating the Summit with Ease

Your Questions Answered: Navigating the Summit with Ease

FAQs

What professionals benefit most from attending the Tax Business Summit?

The Tax Business Summit is ideal for tax professionals, aspiring preparers, firm owners, franchisees, accountants, bookkeepers, and financial service providers looking to grow their business, stay compliant, and gain insider strategies. Whether you're just starting or scaling up, this event provides powerful tools, industry updates, and connections to take your business to the next level.

How can I register for the Tax Business Summit?

Are there opportunities to speak or present at the summit?

Yes, Interested speakers are welcome to submit their proposals to [email protected] or call (866) 297-9829 for more information.

What are the benefits of attending the Tax Business Summit?

Gain insider knowledge through keynote presentations, panels, and interactive sessions led by top professionals in the tax industry.

Hands‑On Training & Education – Equip yourself with practical skills via live demos, interactive workshops, and real-world sessions tailored for tax business growth.

Networking Opportunities – Connect with fellow tax preparers, accountants, franchisees, and service providers—forming relationships that can lead to partnerships, referrals, and collaborative opportunities.

Access to Cutting‑Edge Tools & Vendors – Explore booths from leading software and technology providers, try live demos, and take advantage of special vendor discounts.

Will there be opportunities to interact with speakers and experts

Absolutely We arrange meet-and-greet sessions, Q&A sessions after each talk, and networking events designed to facilitate personal interactions with speakers and other leading professionals

Can I get a refund if I am unable to attend after registration?

No, please note that all sales are final and non-refundable.